Precision Manufacturing Trends in Miniature Roller Chains

I. Driving Forces of Precision Transformation in the Global Miniature Roller Chain Market

As a global wholesale buyer, you are facing a core challenge brought about by the upgrading of the manufacturing industry: downstream applications (new energy vehicles, industrial robots, medical devices) are continuously increasing their requirements for the precision, lifespan, and environmental friendliness of transmission components. Data shows that the global precision miniature roller chain market will experience a compound annual growth rate of 8% from 2024 to 2030, with demand for products with a pitch ≤6.35mm growing by over 25%. This trend is driven by three core forces:

**The Rigid Requirements of Smart Manufacturing** Industry 4.0 is driving the automation and intelligent transformation of production lines. Scenarios such as robot joint transmission and precision conveying equipment are placing stringent standards on roller chains for tolerance control (≤±0.02mm) and operating noise (≤55dB). Leading international companies have adopted AI quality inspection systems and digital twin technology, increasing product qualification rates to over 99.6%, which has become a core threshold for procurement decisions.

Explosive Demand from New Energy and High-End Equipment: The penetration rate of precision roller chains in the powertrain systems of new energy vehicles will climb from 18% in 2024 to 43% in 2030, requiring products to be lightweight (30% lighter than traditional chains), heat resistant (-40℃~120℃), and have low wear characteristics. Meanwhile, the demand from the medical device and aerospace sectors for biocompatible materials and explosion-proof designs is driving special miniature roller chains to become a high-value-added growth point.

Mandatory Constraints from Global Environmental Regulations: The EU Carbon Border Tax (CBAM) and the US EPA environmental standards require low-carbonization throughout the supply chain. After the implementation of the new version of the “Clean Production Evaluation Index System for the Chain Industry” in 2025, the market share of environmentally friendly roller chains (using recyclable alloy steel and chromium-free surface treatment) will exceed 40%, and carbon footprint certification will become a prerequisite for international procurement.

II. Three Core Technological Trends in Precision Manufacturing

1. Materials and Processes: From “Meeting Standards” to “Exceeding” International Standards

Materials Innovation: Increased application of lightweight materials such as graphene-reinforced composites and titanium alloys, reducing energy consumption while ensuring tensile strength (≥3.2kN/m);

Precision Machining: Seven-axis machining centers achieve stable tooth profile accuracy up to ISO 606 AA level, with roller outer diameter tolerance controlled within ±0.02mm;

Surface Treatment: Vacuum nickel plating and phosphorus-free passivation processes replace traditional electroplating, meeting RoHS and REACH environmental requirements, and achieving salt spray testing of over 720 hours.

2. Intelligentization and Customization: Adapting to Complex Application Scenarios

Intelligent Monitoring: Intelligent roller chains integrating temperature and vibration sensors can provide real-time feedback on operating status, reducing the risk of equipment downtime. These products are projected to account for 15% of the market by 2030.

Flexible Manufacturing: Leading manufacturers can quickly respond to OEM/ODM needs, providing modular designs for scenarios such as medical robots and semiconductor equipment. The minimum pitch can be customized to 6.00mm (e.g., DIN 04B-1 standard).

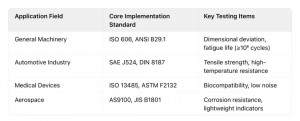

3. Standards Compliance: The “Passport” to Global Sourcing International sourcing requires verifying that suppliers meet multi-regional standards.

III. Supply Chain Optimization Strategies

1. Core Supplier Evaluation Indicators

Technical Strength: R&D investment ≥ 5%, possessing precision machining equipment (e.g., CNC gear hobbing machine positioning accuracy ±2μm);

Production Capacity Stability: Annual production capacity ≥ 1 million sets, with multiple regional production bases (e.g., Yangtze River Delta, Southeast Asia) to circumvent trade barriers;

Certification System: Holding ISO 9001 (quality), ISO 14001 (environmental), and IATF 16949 (automotive industry) certifications;

Delivery Capability: Bulk order delivery cycle ≤ 30 days, supporting tariff reduction declarations under the RCEP framework. 2. Regional Market Opportunities and Risk Warnings

* Growth Market: Southeast Asia (RCEP member countries) is experiencing accelerated industrial automation. China’s exports of miniature roller chains to this region are projected to exceed US$980 million in 2026, allowing buyers to leverage the regional supply chain to reduce costs.

* Risk Mitigation: Pay attention to the import dependence on high-end alloy steel (currently, 57% of the global supply is imported). Choose suppliers that cooperate with leading domestic material manufacturers to mitigate the impact of raw material price fluctuations.

IV. Trends in 2030

* Smart Chains Become Standard: Miniature roller chains with built-in sensors will have a penetration rate exceeding 30% in high-end equipment, making data-driven predictive maintenance a core competitive advantage.

* Deepening Green Manufacturing: Products with traceable carbon footprints and ≥80% recyclable materials will receive more favorable evaluations in international bidding.

* Rise of Modular Procurement: Integrated solutions combining “chain + sprocket + maintenance tools” will become a key model for reducing procurement costs.

Post time: Nov-17-2025